Understanding Intelius Charges on Your Debit Card

In today’s digital age, protecting personal information and managing online transactions are pivotal concerns for many. If you’ve noticed an unfamiliar charge on your debit card with the descriptor "Intelius," you might be curious or even concerned about what this payment entails. This article delves into what Intelius is, why it might appear on your statement, and how to handle unexpected charges.

What is Intelius?

Intelius is a company that provides consumers with access to public records and personal information. They offer services like background checks, people searches, and reverse phone lookups. If you’ve used any form of their service, it’s likely that this charge relates to that usage.

Why Would Intelius Appear on Your Debit Card Statement?

-

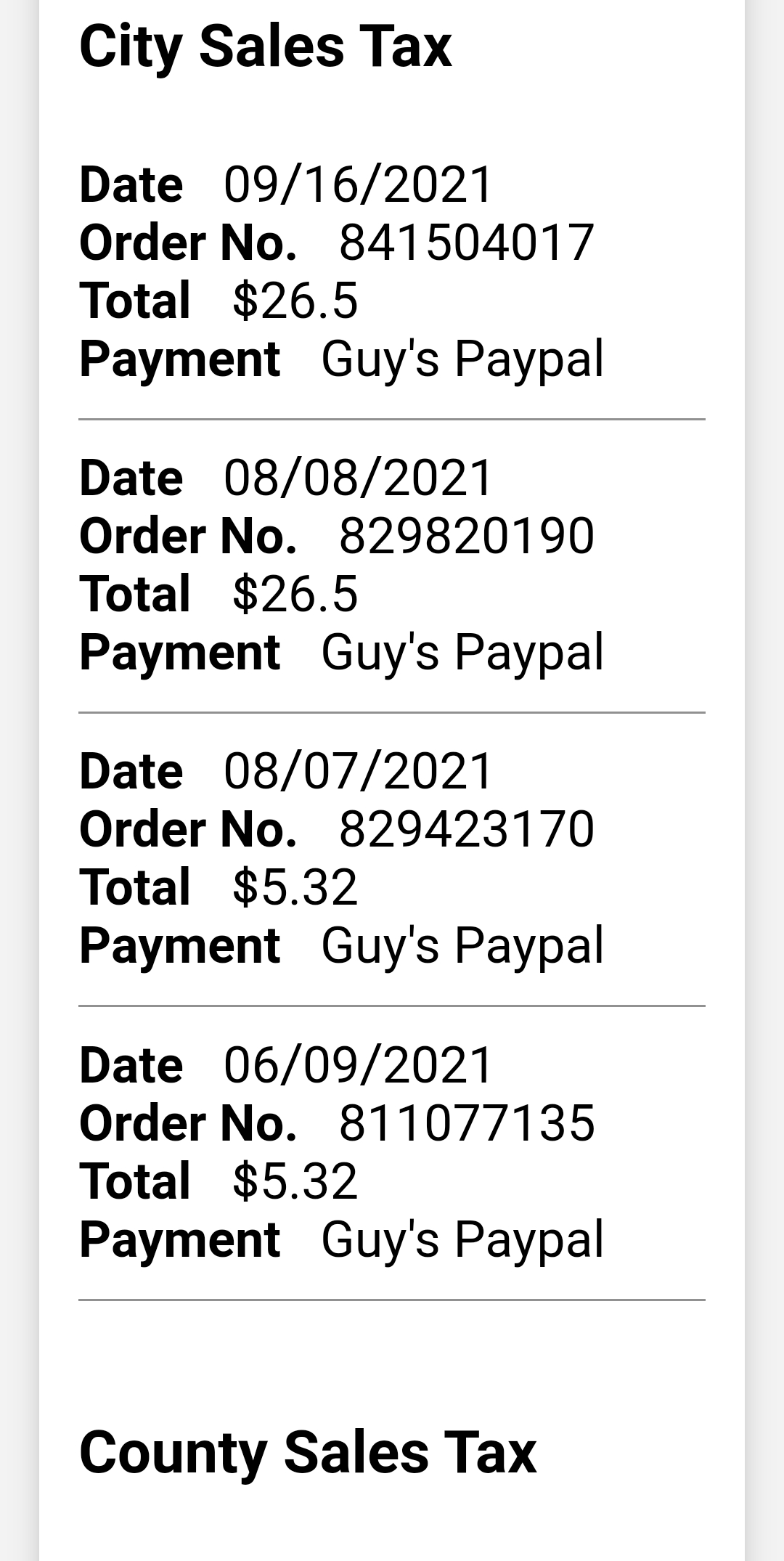

Direct Subscription: If you’ve signed up for any of their subscription services, Intelius might automatically bill your debit card for your membership dues.

-

One-Time Service Use: Perhaps you’ve utilized a single report or lookup, which can result in a one-time charge.

-

Automatic Renewals: Many subscription services, including those offered by Intelius, renew automatically unless you opt-out or cancel the service. An unsuspecting debit card charge could be from a renewal.

-

Unauthorized Use: In some unfortunate cases, personal information might be used without consent. This could lead to charges you’re unaware of until you check your bank statement.

Examining the Charges

When you see an Intelius charge, here’s what you should do:

-

Verify the Charges: Check your records or subscription details to see if you’ve forgotten about any services you’ve subscribed to or used.

-

Contact Intelius: If there’s any doubt, directly reaching out to Intelius’s customer support can clarify the charge. Most reputable companies have efficient customer service to handle such inquiries.

-

Check Terms of Service: If you remember signing up, go back to the terms of service you agreed to. Often, these contain details regarding charges, renewals, and cancellation policies.

Preventing Unauthorized Charges

To avoid unexpected charges from Intelius or similar services:

-

Understand Services Before Subscribing: Always read the full terms of service, especially the billing section.

-

Regular Monitoring: Regularly check your bank and credit card statements. Early detection can prevent multiple unauthorized charges.

-

Use Strong Passwords: Ensure each account is secured with a strong, unique password to reduce the chance of your information being used fraudulently.

-

Setup Alerts: Many banks offer alert services for charges. Enabling these can help you stay on top of your account activity.

Addressing Issues

If you find out that a charge wasn’t authorized:

-

Dispute immediately: Contact your bank. Explain the situation and request a chargeback if necessary.

-

Inform Intelius: Report the unauthorized usage to Intelius as well. Companies like Intelius have procedures to manage and possibly refund unauthorized transactions.

-

Enhance Security: Following such an incident, take measures to strengthen your personal online security. This could mean changing passwords, setting up two-factor authentication, or even using payment services that offer better transaction control.

Understanding why Intelius or similar charges appear on your debit card involves recognizing the services provided by these companies, the nature of subscriptions, and the mechanisms of digital transactions. With vigilance, clear understanding, and prompt action, managing and preventing such charges becomes much simpler, ensuring your financial wellbeing remains intact.