In Austin, Texas, sales tax is an important economic factor, which affects consumers’ shopping decisions and merchants’ pricing strategies. Understanding Austin’s sales tax is not only very important for residents and tourists, but also has a far-reaching impact on business owners and investors. This paper will discuss Austin’s sales tax rate, its impact on the economy and how to plan consumption reasonably.

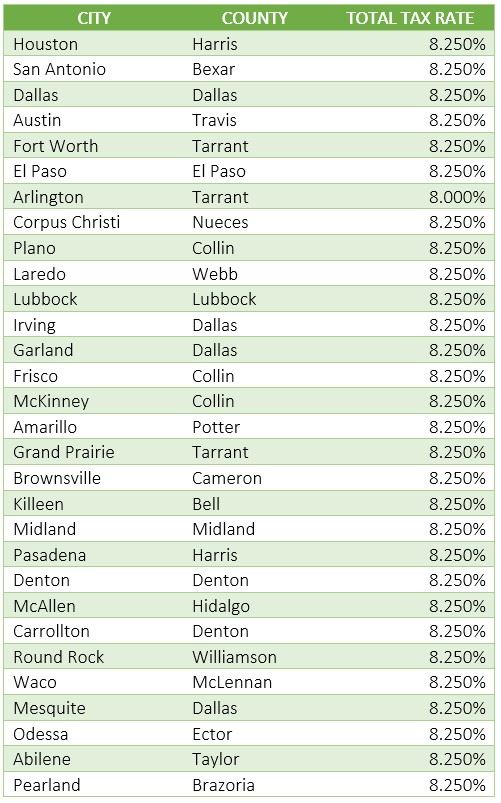

Austin’s sales tax rate is currently 8.25%. This tax rate consists of state sales tax and local sales tax. The basic sales tax rate in Texas is 6.25%, while the local tax in Austin has increased by 2%. This tax rate is at a moderate level nationwide, neither too high nor too low. For consumers, this means that when buying goods and services, in addition to the price of the goods themselves, they also need to pay a certain percentage of taxes and fees.

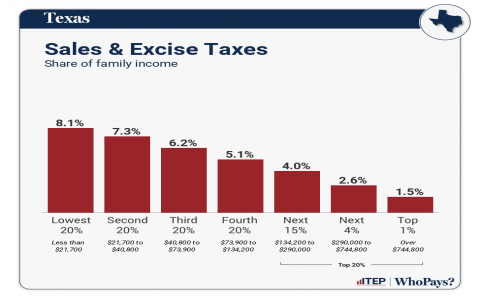

Sales tax is levied in a wide range, covering most goods and services, including retail goods, catering services and some entertainment activities. However, some goods and services are tax-free, such as prescription drugs and certain foods. This tax exemption policy aims to reduce the burden of low-income families and ensure that basic living needs are not affected by excessive tax burden.

The impact of sales tax on the economy is obvious. First of all, sales tax provides important financial revenue for local governments, which is used for the provision of public services, such as education, transportation and infrastructure construction. As a rapidly developing city, Austin relies on these funds to support its growing population and economic activities. Secondly, sales tax will also affect consumers’ buying behavior. Higher sales tax may lead consumers to be more cautious when shopping, choose cheaper substitutes or postpone their purchase decisions.

for merchants, the existence of sales tax means that the influence of taxes and fees should be considered when pricing. Merchants usually include sales tax in the list price of goods, so that consumers can clearly see the total cost when they check out. This practice helps to improve transparency, but it may also affect consumers’ willingness to buy. Especially in the highly competitive market, businesses need to find a balance point to ensure that they can attract customers while maintaining reasonable profits.

In Austin, with the vigorous development of technology and innovation industries, more and more enterprises are beginning to pay attention to how to optimize costs through reasonable tax planning. Many business owners realize that understanding the relevant laws and policies of sales tax can help them reduce their tax burden within a legal framework, thus improving their competitiveness. In addition, with the rise of e-commerce, the tax issue of online sales has gradually become the focus of business attention. The tax policy of online sales in Texas is constantly evolving, and businesses need to know the relevant laws and regulations in time to ensure compliance.

Consumers’ tax awareness when shopping is also gradually increasing. More and more people are beginning to pay attention to the total cost of goods, including sales tax. This trend urges businesses to be more transparent in pricing and provide clear tax information to meet the needs of consumers. At the same time, consumers are also looking for businesses that can provide more competitive prices to reduce shopping costs.

In Austin, sales tax is not only a simple tax issue, but also a multiple factor that affects the economy and society. It is very important for residents, businesses and investors to understand the composition, influence and function of sales tax in daily life. Through reasonable consumption planning and tax management, both individuals and enterprises can achieve better economic benefits in this dynamic city.