in Travis county, Texas, the issue of property tax has aroused widespread concern and discussion. With the rising house prices, many residents find themselves facing a higher and higher burden of property tax. This phenomenon not only affects the family’s economic situation, but also raises questions about the local government’s tax policy. This paper will discuss the property tax in Travis County, analyze its impact on residents’ lives, and discuss possible solutions.

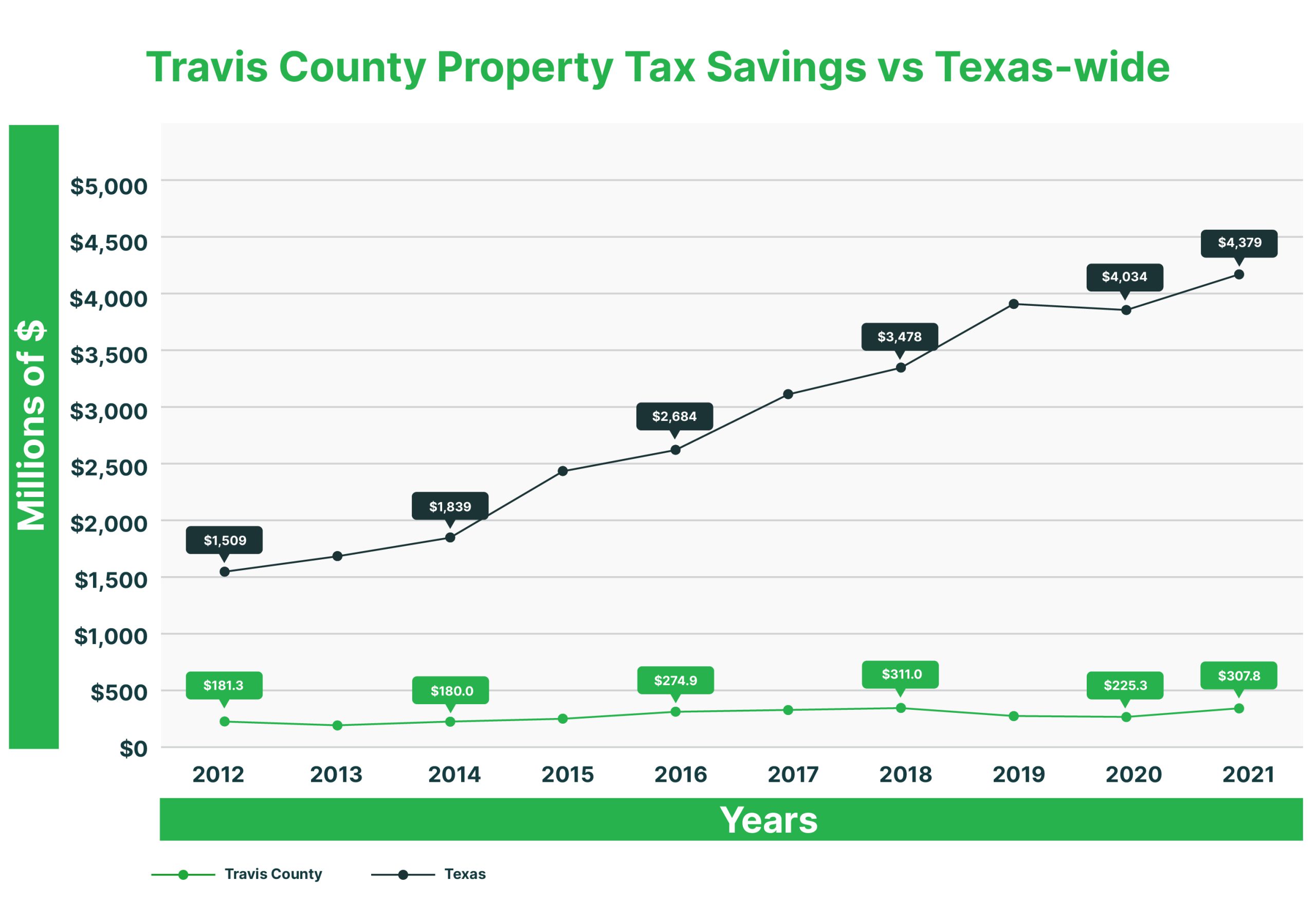

in recent years, the real estate market in Travis county has experienced remarkable growth. According to the latest data, house prices have increased by nearly 30% in the past few years. This rapid growth has greatly increased the property tax assessment value of many families, resulting in an increase in their tax bills. For some low-income families and elderly people with fixed income, this change may cause great economic pressure. Many people began to question whether the local government is evaluating and collecting property tax reasonably.

the increase of property tax not only affects the quality of life of residents, but also may lead to the division of communities. The high tax burden makes some families have to consider moving out of Travis County to find more affordable places to live. This migration phenomenon may lead to the decrease of community diversity and affect the local cultural and economic vitality. At the same time, residents who stay in the county may be dissatisfied with the increase in tax burden, and then their trust in local governments will decline.

In this context, residents began to take an active part in protests, demanding that local governments take measures to reduce the burden of property taxes. Protesters believe that the government should re-examine the evaluation criteria of property tax to ensure its fairness and transparency. They called on the government to adopt a more reasonable tax policy to protect the interests of residents. Many residents also put forward specific suggestions, such as setting a property tax ceiling or providing tax relief for low-income families.

In addition, residents are also seeking legal ways to challenge unreasonable tax assessment. Some people choose to hire professional appraisers to help them re-evaluate their property to ensure that the assessment of the tax bureau is fair. This practice has, to a certain extent, raised residents’ concern about the property tax assessment process, and also prompted local governments to pay more attention to the accuracy of the assessment.

in Travis county, the complexity of property tax is not only reflected in the economic level, but also involves social equity and government responsibility. Residents hope to urge the government to adopt a more reasonable tax policy through protests and legal means to reduce their economic burden. At the same time, local governments also need to listen carefully to the voices of residents and actively respond to their concerns in order to maintain social harmony and stability.

As the protests continue, the property tax issue in Travis County will continue to be the focus of public attention. Residents’ efforts are not only for their own interests, but also to promote a more just and transparent tax system. Only through joint efforts can we achieve a fairer society and let every resident live and work in this beautiful county.