Non-Maryland Losses and Adjustments: Understanding the Implications

In the complex landscape of taxation, the concept of “non-Maryland losses and adjustments” emerges as a critical area for both individuals and businesses. This topic encompasses the various losses incurred outside of Maryland and the subsequent adjustments that must be made when filing taxes. Understanding these elements is essential for ensuring compliance and optimizing tax liabilities.

When taxpayers experience losses, whether through business operations, investments, or other financial activities, these losses can often be used to offset income, thereby reducing overall tax liability. However, the treatment of these losses can vary significantly depending on the jurisdiction. For Maryland residents, losses incurred outside the state—referred to as non-Maryland losses—require careful consideration during tax preparation.

Non-Maryland losses can arise from various sources, including business ventures in other states, rental properties, or capital losses from investments. These losses are particularly relevant for individuals and businesses that operate in multiple states. The ability to claim these losses on Maryland tax returns hinges on specific regulations and guidelines set forth by the Maryland Comptroller’s office.

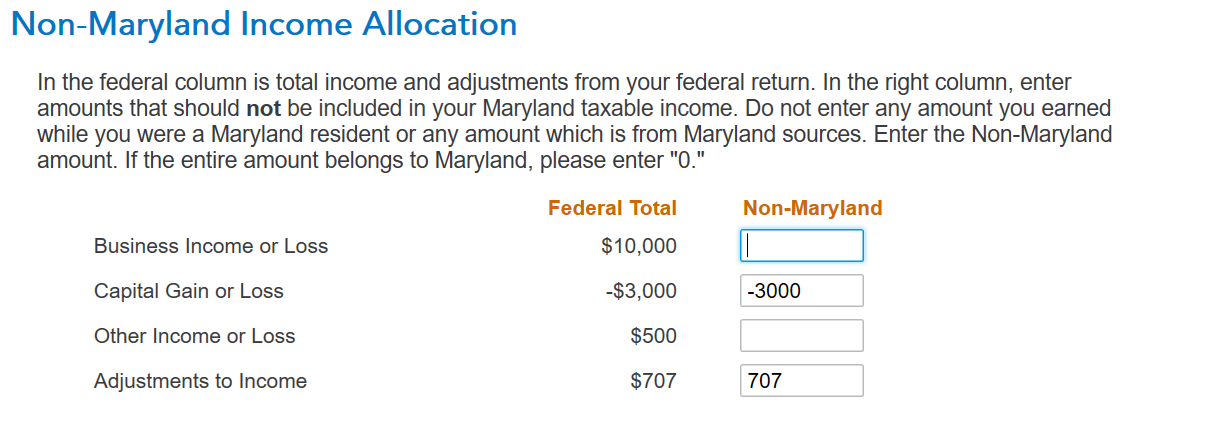

One of the primary adjustments that taxpayers must consider is the apportionment of income and losses. Maryland employs a formula to determine how much of a taxpayer’s income is subject to state taxation. This formula takes into account the proportion of business activity conducted within the state compared to other jurisdictions. As a result, non-Maryland losses may not be fully deductible against Maryland income, leading to potential tax implications.

Taxpayers must also be aware of the carryover provisions associated with non-Maryland losses. If a taxpayer cannot fully utilize their losses in a given tax year, they may be able to carry those losses forward to future years. This can provide significant tax relief in subsequent years when income may be higher. However, the rules governing these carryovers can be intricate, and it is crucial to maintain accurate records and documentation to support any claims made.

Another important aspect to consider is the impact of federal tax laws on state tax filings. The federal government allows for the deduction of certain losses, which can influence how states like Maryland treat these losses. Taxpayers must navigate the interplay between federal and state regulations to ensure they are maximizing their tax benefits while remaining compliant with all applicable laws.

In addition to understanding the mechanics of non-Maryland losses, taxpayers should also be aware of the potential for audit risks. The complexity of multi-state taxation can raise red flags for tax authorities, leading to increased scrutiny of returns that claim significant non-Maryland losses. To mitigate this risk, it is advisable to work with tax professionals who are well-versed in both Maryland and federal tax laws. They can provide guidance on proper documentation and help ensure that all claims are substantiated.

Furthermore, the timing of losses can also play a crucial role in tax planning. Taxpayers should consider the timing of recognizing losses, as this can affect their overall tax strategy. For instance, if a taxpayer anticipates a higher income in the following year, it may be beneficial to defer the recognition of certain losses to offset that income.

Ultimately, navigating the landscape of non-Maryland losses and adjustments requires a thorough understanding of both state and federal tax laws. Taxpayers must remain vigilant in tracking their financial activities and understanding how these activities impact their tax obligations. By doing so, they can effectively manage their tax liabilities and take advantage of available deductions and credits.

As the tax landscape continues to evolve, staying informed about changes in regulations and best practices is essential. Engaging with tax professionals and utilizing available resources can empower taxpayers to make informed decisions regarding their non-Maryland losses and adjustments, ultimately leading to more favorable tax outcomes.