How to Move Out When You Have No Money

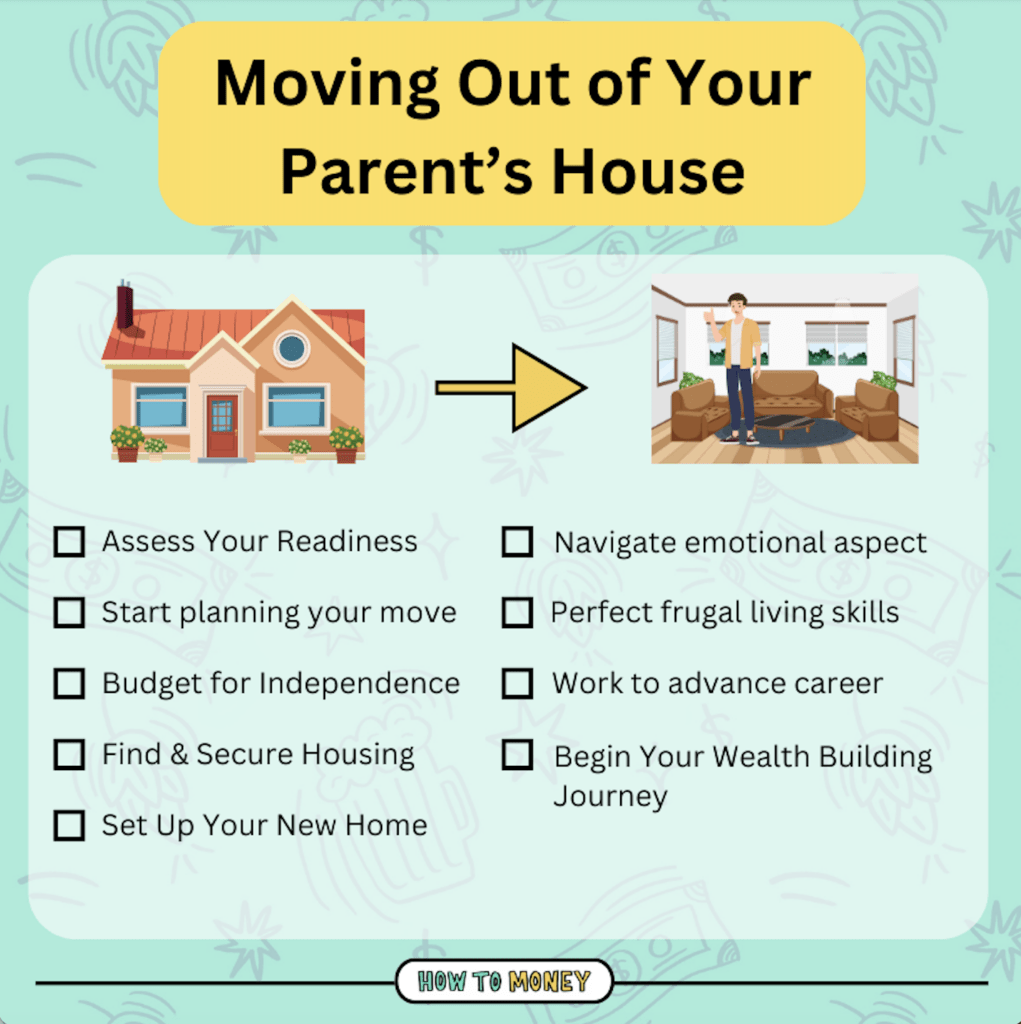

Moving out of your current living situation when you’re financially strapped might sound like an insurmountable challenge, but it’s not impossible. It requires resourcefulness, determination, and some strategic planning. Here, we’ll explore practical steps you can take to break free from financial constraints and make the move out a reality.

Reassess Your Necessities

The first thing to do is distinguish between your wants and needs. When you’re financially limited, prioritizing what you absolutely need becomes critical. Can you live with less? Here are some areas to consider:

-

Housing: Is it realistic to look for a modest room in a shared house rather than a new apartment? Websites and apps like Craigslist or local social media groups often have listings for such arrangements.

-

Utilities: Instead of setting up for high-speed internet or cable, could basic utilities suffice for now?

By drastically reducing your initial living costs, your financial burden lessens, which aids in making the move less daunting.

Expand Your Income Streams

Consider if there’s anything you can do to increase your income:

- Part-Time Work: Look for jobs that offer free accommodation or can be done remotely.

- Freelancing: Utilize any skills you have that can be marketed on platforms like Upwork or Fiverr to earn extra cash.

Every little bit helps when you’re planning to move out without substantial savings.

Find a Roommate

Sharing accommodations can significantly lower your living expenses. Here’s how to go about it:

-

Compatibility: Ensure your potential roommate has similar living habits and financial realities. Living with someone who can’t afford their part of the rent won’t solve your financial woes.

-

Affordable Housing: Teams up where you can share both costs and responsibilities. Keep in mind, a good roommate can make a tight budget feel comfortable.

Leverage Assistance Programs

There are government and non-profit programs designed to help individuals in financial distress:

-

Housing Assistance: Check if you qualify for any assistance programs designed to help with rent or deposits, like Section 8 Housing Choice Voucher Program.

-

Food Programs: Programs like SNAP can also alleviate some of your costs, freeing up more money for housing.

Understanding these programs and applying early can provide a safety net during your move.

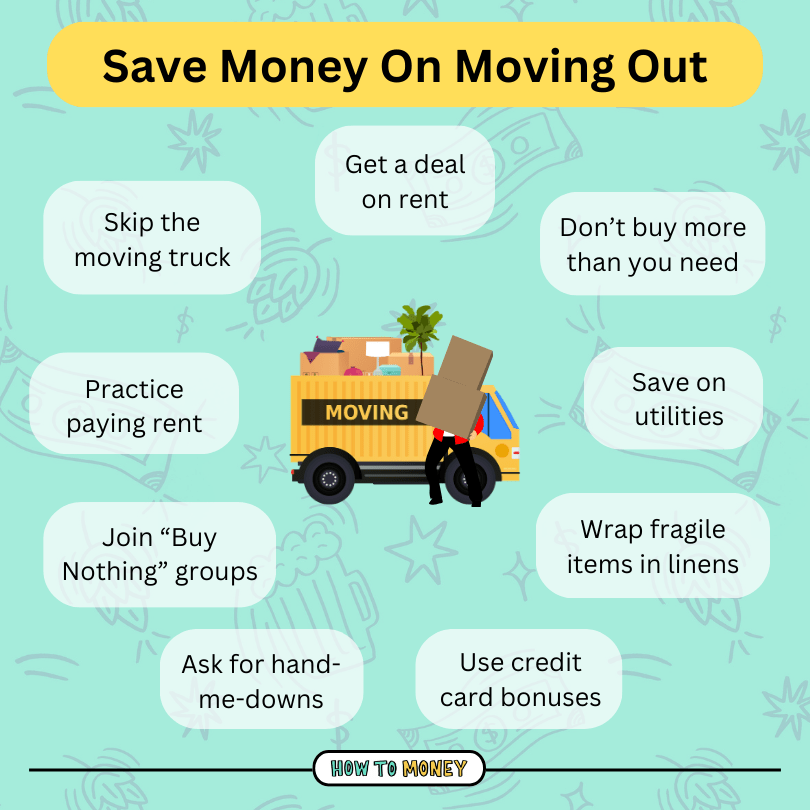

Be Savvy with Savings

Look for ways to reduce costs:

-

DIY Moving: Instead of hiring movers, gather friends or use public transport or rent a truck for the day.

-

Shop Wisely: Furniture, kitchenware, and electronics can often be found secondhand. Online marketplaces, garage sales, or swap meets become your new treasure troves.

Being frugal at the beginning will significantly lower your upfront expenses, making the move much more feasible.

Community Support

Lastly, communities can be invaluable:

-

Ask for Help: Sometimes, friends or community members can offer temporary solutions like extra space for storage or even help with moving.

-

Volunteering: Not only can volunteering help you get out of the house, but it can also connect you with potential support networks or roommates.

By integrating into a community, you build networks that can provide assistance or leads when you least expect it.

When you’re ready to take the step to move out, remember that the key is adaptability, seeking help, and making the most of every resource available to you. With careful planning and smart choices, moving out with little money is not just a dream but an achievable goal.