How to File Taxes for Stay-at-Home Moms

Being a stay-at-home mom involves juggling numerous responsibilities and multitasking like no other. However, amidst the daily hustle, one might easily overlook the importance of keeping track of financial matters, particularly when it comes to tax season. Filing taxes might seem daunting, but with the right knowledge, it becomes manageable, and it could even offer unexpected financial benefits.

Understanding Your Tax Status

First and foremost, understanding your tax status is crucial. As a stay-at-home mom, if you’re married and filing jointly, then your spouse’s income will be the primary source for tax calculations. However, if you’ve had any income during the year, perhaps from freelancing, a small business, or investment income, these also need to be reported.

Income from Side Hustles or Investments

If you’ve earned money from what is often referred to as a side hustle or through investments:

-

Side Hustles: Income from home businesses, freelance work, or even selling homemade goods needs to be reported. This income typically includes earnings from crafting, tutoring, or providing childcare services outside your immediate family.

-

Investments: Dividends, interest, or capital gains from stocks, mutual funds, or bonds should be included in your tax return. Keep records of all financial transactions related to these investments.

Deductions and Credits

Stay-at-home moms can take advantage of several tax benefits designed for families:

-

Child Tax Credit: You might be eligible for this credit for each child under 17. It’s designed to reduce the tax bill for families.

-

Child and Dependent Care Credit: If you’ve paid for childcare to allow you or your spouse to work or look for work, you could be eligible for this credit. This can include day care fees, nanny services, or after-school programs.

-

Education Credits: If you’ve been taking classes or if your spouse or child is in college, consider education-related tax credits.

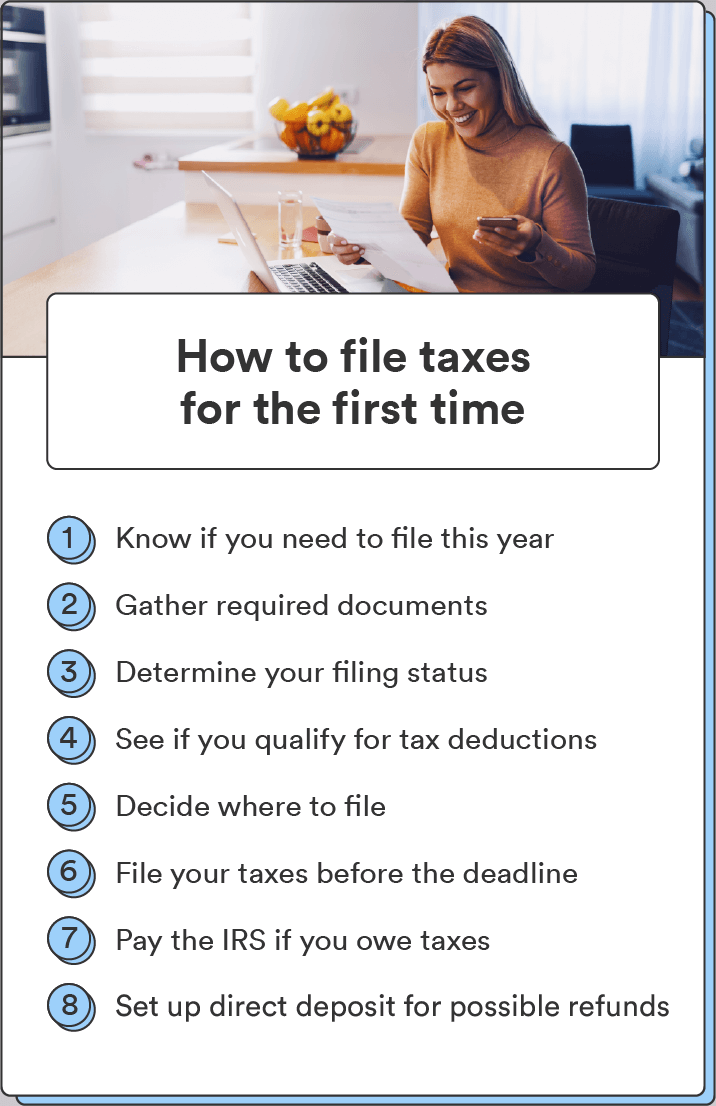

Filing Your Taxes

Here are steps to help you through the filing process:

-

Collect Documentation: Gather all necessary documents like W-2s from your spouse’s employer, any 1099 forms for your income, receipts for deductible expenses, etc.

-

Use Tax Software or Hire a Professional: Many opt for user-friendly tax software which guides you through the process, asking all the right questions to ensure compliance. If your situation is complex, or if you prefer a more personal touch, consulting with a tax professional can also be beneficial.

-

Stay Organized: Keeping your financial documents in order throughout the year simplifies the process at tax time. This includes keeping track of medical expenses, donations, and any other potential deductions.

-

File on Time: The deadline for filing federal taxes in the U.S. is generally April 15th. Extensions can be filed, but they’re for filing, not for paying taxes if any are due.

Why It Matters

Taking the time to file taxes correctly as a stay-at-home mom not only ensures compliance with tax laws but can also lead to financial savings. You might be eligible for refunds or credits that offset your tax bill, potentially returning money to you. Moreover, it sets a precedent for financial responsibility and offers a lesson in financial management for any children looking on.

Navigating the tax system as a stay-at-home mom might initially seem like a herculean task, but armed with the right knowledge, it becomes a step towards securing your family’s financial well-being. By understanding your tax obligations and exploring available benefits, you can turn what might seem like a chore into an opportunity for financial empowerment. Remember, every dollar counts, and every tax benefit or credit you qualify for is a step towards a more secure economic future for your family.