Navigating the complexities of accounting can sometimes be daunting, particularly when it comes to calculating the accretion of interest on leased liabilities. In recent years, with the adoption of new accounting standards like IFRS 16 and ASC 842, understanding the nuances of lease liabilities and the related interest components has become essential for businesses across the globe. This guide aims to demystify the process, offering clarity on how to calculate these essential figures.

Understanding Lease Liabilities and Interest Accretion

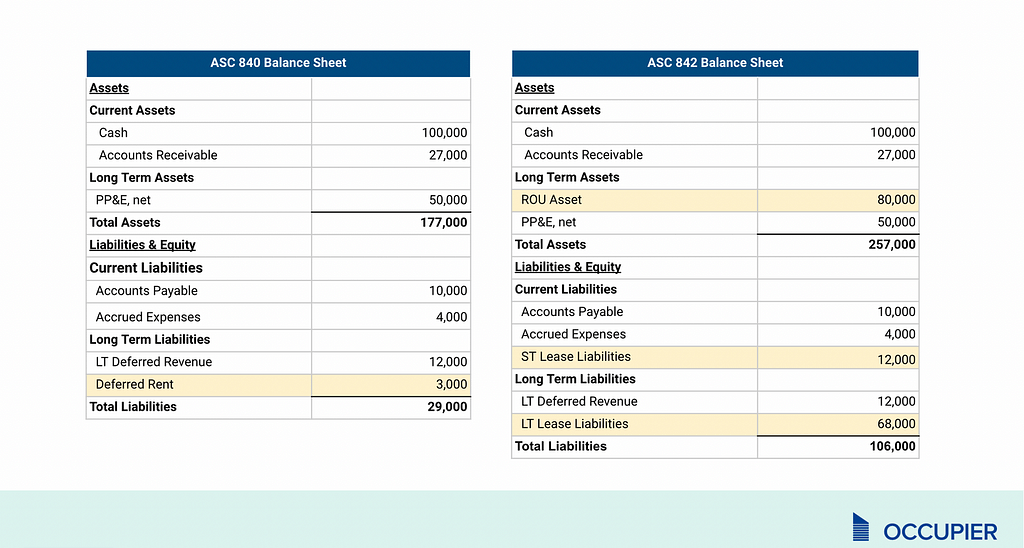

At its core, a lease liability represents the obligation of the lessee to make lease payments over the term of the lease. When a company enters into a lease, it records a lease liability on its balance sheet, reflecting the present value of future lease payments. As time progresses, this liability does not simply sit idle; it grows due to the interest component.

Interest accretion refers to the process of increasing the lease liability to reflect the interest cost associated with it. This is a crucial element of lease accounting because it integrates the temporal dimension—acknowledging that money today is worth more than the same amount in the future due to the time value of money.

Key Components in the Calculation

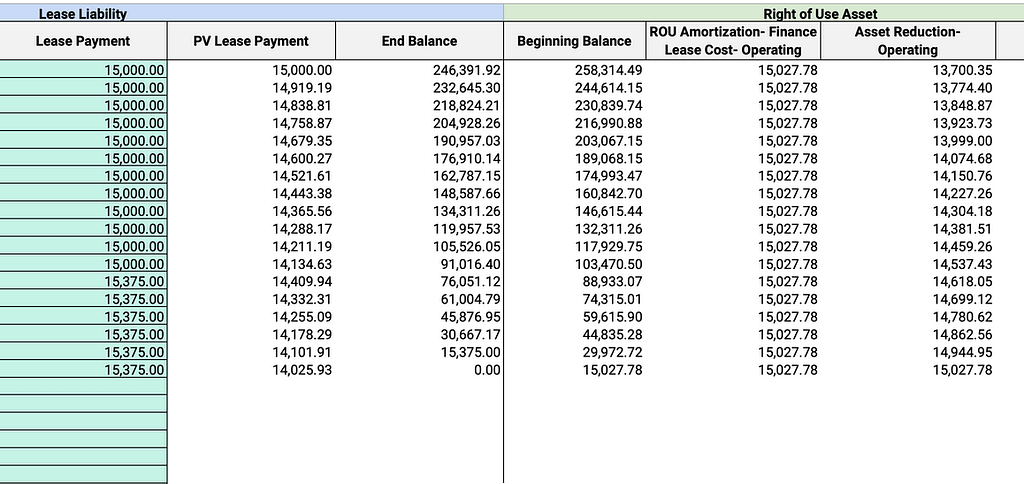

Three primary elements are essential for calculating the accretion of interest in lease liabilities: the lease liability’s opening balance, the effective interest rate, and the lease payments made during the period.

-

Opening Lease Liability Balance: This is the initial recognition amount or the balance at the start of the period for which you are calculating interest accretion.

-

Effective Interest Rate: This is often referred to as the lessee’s incremental borrowing rate. It’s the rate the lessee would have to pay to borrow, over a similar term and with a similar security, the funds necessary to obtain an asset of similar value.

-

Lease Payments: These are the payments made throughout the lease term, covering both interest expense and the reduction of the lease liability itself.

Calculating Interest Accretion

To calculate the accretion of interest, multiply the opening balance of the lease liability by the effective interest rate. For example, if your opening lease liability is 100,000 and your effective interest rate is 5%, the interest expense for that period would be 5,000. This amount is added to your lease liability, reflecting its growth over time. From this total, you subtract any lease payments made to find the closing balance of the lease liability.

This calculation needs to be performed consistently at each reporting period to ensure the lease liability is accurately reflected in financial statements.

The Impact of Accurate Calculations

Accurate calculations of the interest accretion on lease liabilities are imperative for several reasons. Firstly, they ensure compliance with financial reporting standards. Secondly, they provide a transparent picture of the company’s financial health, aiding stakeholders in making informed decisions. Finally, missed interest calculations or inaccuracies can lead to restatements or misinterpretations, affecting credibility with investors and regulatory bodies.

Moreover, the proper management and recording of lease liabilities can significantly impact a company’s balance sheet and various financial ratios. An inflated liability due to improper interest calculation may affect debt-to-equity ratios, influencing investment decisions and creditor evaluations.

Incorporating lease liabilities into financial statements is more than a compliance necessity; it is a strategic component of financial management. Ensuring accurate calculations of interest accretion not only helps maintain regulatory alignment but also empowers businesses to manage their operational finances more effectively. Whether a business is leasing office equipment, real estate, or machinery, recognizing the full scope of its financial obligations fortifies its standing and readiness for future opportunities.