Empowerment Retirement Withdrawal: A Path to Financial Freedom

As individuals approach retirement, the concept of empowerment becomes increasingly significant. The ability to make informed decisions about retirement withdrawals can greatly influence one’s financial stability and overall quality of life. This article delves into the importance of understanding retirement withdrawal strategies, emphasizing how empowerment in financial planning can lead to a more secure and fulfilling retirement.

Retirement is often viewed as a time to relax and enjoy the fruits of one’s labor. However, it also presents unique financial challenges. Many retirees find themselves navigating a complex landscape of savings, investments, and withdrawal strategies. Empowerment in this context means equipping oneself with the knowledge and tools necessary to make sound financial decisions. This proactive approach can help retirees avoid common pitfalls and maximize their resources.

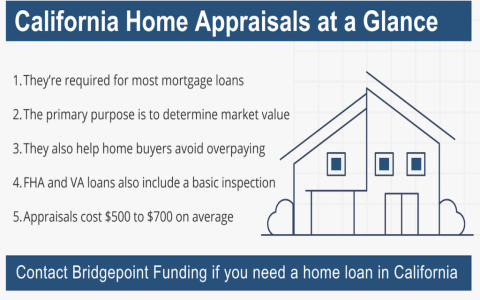

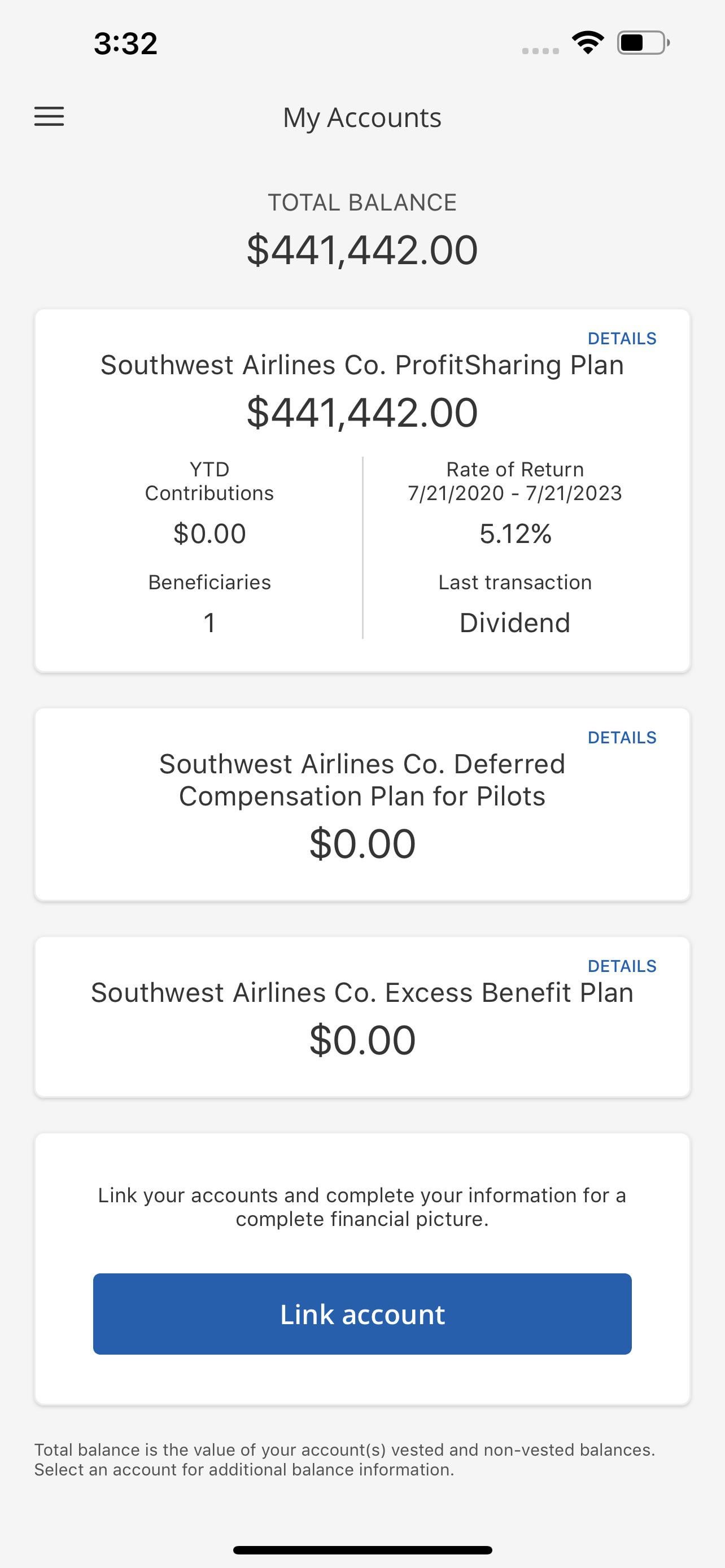

One of the key aspects of retirement withdrawal is understanding the various sources of income available. Social Security benefits, pensions, and personal savings all play a crucial role in a retiree’s financial landscape. Each source has its own rules and implications for withdrawal. For instance, withdrawing from a 401(k) or IRA before the age of 59½ can result in penalties, while Social Security benefits can be claimed at different ages, affecting the monthly payout. Being aware of these nuances allows retirees to strategize their withdrawals effectively.

Another important factor is the concept of sustainability. Retirees must consider how long their savings will last, especially in the face of rising healthcare costs and inflation. A common strategy is the “4% rule,” which suggests that withdrawing 4% of one’s retirement savings annually can provide a steady income stream without depleting the principal too quickly. However, this rule is not one-size-fits-all. Each individual’s situation is unique, and factors such as lifestyle, health, and market conditions must be taken into account. Empowerment comes from tailoring withdrawal strategies to fit personal circumstances.

Tax implications also play a significant role in retirement withdrawals. Different accounts are taxed differently, and understanding these differences can lead to more efficient withdrawal strategies. For example, withdrawing from a traditional IRA is subject to income tax, while Roth IRA withdrawals are tax-free if certain conditions are met. By strategically planning withdrawals to minimize tax liabilities, retirees can preserve more of their hard-earned savings. This level of financial literacy is essential for empowerment in retirement planning.

Moreover, the emotional aspect of retirement withdrawals cannot be overlooked. Many retirees experience anxiety about running out of money, which can lead to overly conservative withdrawal strategies. This fear can hinder their ability to enjoy retirement fully. Empowerment involves not only financial knowledge but also the confidence to make decisions that align with one’s values and goals. Engaging with financial advisors or retirement planning workshops can provide the necessary support and reassurance.

In addition to financial strategies, retirees should also consider their lifestyle choices. The decision to downsize, relocate, or even take on part-time work can significantly impact financial needs and withdrawal strategies. Empowerment in this context means being open to change and adapting to new circumstances. Embracing a flexible mindset can lead to innovative solutions that enhance both financial security and personal satisfaction.

Ultimately, the journey toward a fulfilling retirement is deeply personal. Each individual must assess their unique situation, goals, and values. By taking control of their financial future through informed decision-making, retirees can navigate the complexities of withdrawal strategies with confidence. Empowerment in retirement withdrawal is not just about managing finances; it’s about creating a life that reflects one’s aspirations and dreams.

As individuals prepare for this significant life transition, the importance of education, planning, and adaptability cannot be overstated. By embracing empowerment, retirees can transform their financial landscape, ensuring that their retirement years are not only secure but also rich in experiences and joy.