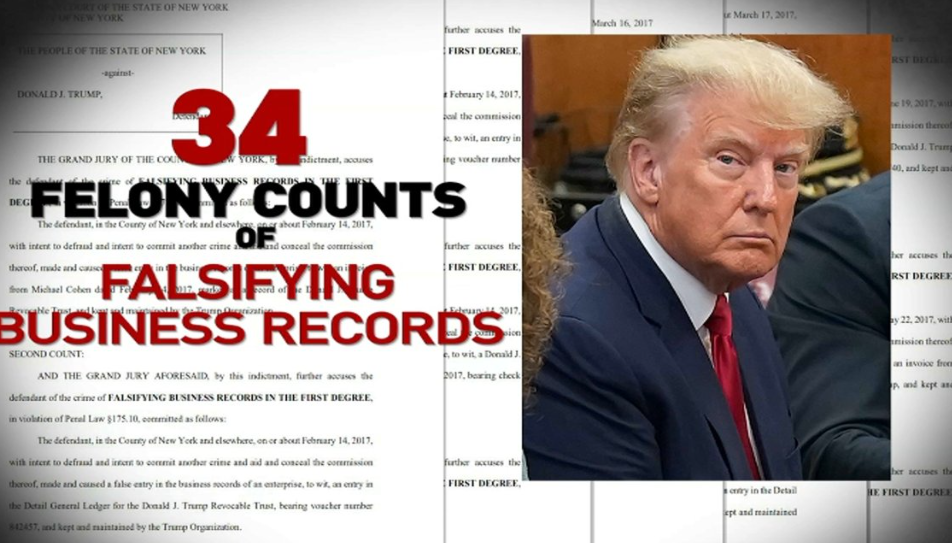

Understanding Prison Sentences for Felony Falsification of Business Records in New York

In the world of business, integrity and transparency are crucial. However, when individuals engage in fraudulent activities such as falsifying business records, the consequences can be severe. In New York, felony falsification of business records represents a serious offense, with the potential for significant prison sentences. This article explores the implications of this crime and what those involved might face.

Falsification of Business Records Defined

Falsification of business records occurs when a person intentionally alters, destroys, or conceals records with the intent to defraud. This could involve tampering with financial documents, invoices, or any other official record that a business is required to maintain. In New York, such actions do not just threaten the integrity of businesses; they also undermine the legal framework that governs commerce.

Classifying the Crime

In New York, the severity of this crime is reflected in its classification. Falsifying business records can be charged as either a misdemeanor or a felony, depending on the circumstances. If the falsification is done to benefit oneself, particularly in a dishonest manner, it often escalates to a felony charge. This distinction is crucial, as felony convictions carry harsher penalties.

The Legal Consequences and Prison Sentences

Individuals convicted of felony falsification can face significant legal repercussions. Under New York law, being found guilty of such a felony can lead to a prison sentence ranging from one to four years. However, the exact length of the sentence may vary based on several factors, including the amount of financial harm caused, prior criminal history, and whether the defendant cooperated with law enforcement during investigations.

In certain cases, courts may also impose additional penalties such as fines or probation, which serve to deter future offenses. The legal system seeks to hold individuals accountable for their actions, especially when they compromise the integrity of business operations and potentially harm other stakeholders.

Factors Affecting Sentencing

Judges consider various factors when determining the length of a prison sentence for felony falsification of business records. These include:

- Intent to Defraud: Demonstrating a clear intention to deceive for personal gain can lead to harsher penalties.

- Nature and Extent of the Fraud: Larger sums of money involved or a greater number of falsified records typically result in more severe sentences.

- Prior Criminal Record: A history of similar offenses can also influence the judge’s decision.

Potential Defense Strategies

For those facing charges, it is essential to understand that every case is unique. Defense strategies may vary widely, encompassing arguments such as lack of intent to defraud, errors in record-keeping that were non-malicious, or even claims of coercion. An effective legal strategy often involves presenting evidence to challenge the prosecution’s narrative and mitigate potential sentences.

The Importance of Compliance

To avoid the repercussions associated with falsifying business records, businesses and individuals must prioritize compliance with all relevant laws and regulations. Ethical practices not only protect against legal action but also foster trust among clients, stakeholders, and the community. Training employees on the importance of accurate record-keeping and firm adherence to company policies can prevent unintentional mistakes that may lead to severe consequences.

Conclusion

Falsifying business records is a serious offense in New York, with felony charges carrying the possibility of substantial prison sentences. Understanding the legal implications and working proactively to foster a culture of honesty within businesses are vital steps toward ensuring compliance and maintaining integrity. By prioritizing ethical practices, individuals and businesses can safeguard themselves against the risks associated with this serious legal issue.