Determining how much rent you can afford while earning $30 an hour is crucial to managing your personal finances smartly. Making the right decision not only ensures financial stability but also affirms a comfortable lifestyle without undue strain. This article delves into the calculations and considerations essential when planning your living expenses on this income.

Starting with the basics, it’s essential to calculate your monthly income. Assuming a typical full-time job with a 40-hour workweek, a 30 hourly rate translates to 1,200 a week. This equates to approximately 4,800 per month before taxes and deductions. Considering tax rates vary, it’s safe to assume around 25-30% of your income will go for taxes, social security, and other obligations, leaving you with a net income of about 3,400 to $3,600 monthly.

Financial experts often suggest that individuals allocate no more than 30% of their monthly take-home pay to housing. This guideline ensures that you maintain a balanced budget for necessities like food, utilities, transportation, and savings. With a monthly net income of 3,500, *following this rule would earmark around 1,050 for rent*.

However, the ideal rent capability isn’t merely dictated by expert recommendations; it greatly hinges on your personal financial goals and current obligations. Do you have existing debts? Are you saving for a substantial purchase or building an emergency fund? These factors may necessitate a lower allocation for rent. Adjusting your budget to accommodate these priorities might mean opting for a more modest dwelling.

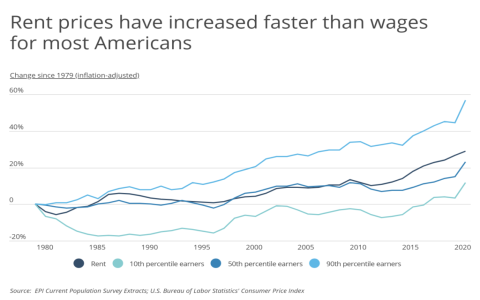

Consideration must also be given to the local housing market. Rental prices fluctuate based on location, making it vital to research average prices in your desired area. An urban apartment may command higher rent compared to a suburban setup, thus impacting your choices. Investigating rental trends and forecasts can provide foresight into potential inflation in living costs, enabling you to make a future-proof decision.

Moreover, lifestyle preferences should not be overlooked. Some individuals value proximity to work or amenities despite higher rent, while others prioritize space or quieter neighborhoods. Aligning your housing option with your lifestyle not only enhances personal satisfaction but can also reveal overlooked cost savings, such as reduced commuting expenses if living closer to work.

Creating a comprehensive budget can solidify understanding and confidence in your rent affordability. Begin by documenting all monthly expenses and savings goals. Identify non-essential costs that can be minimized to bolster your rent fund if necessary. This holistic view of your financial landscape ensures clarity and efficiency, allowing for adjustments that support both present needs and future aspirations.

In certain situations, exploring alternative housing arrangements can offer additional savings. Options like sharing an apartment with roommates can drastically reduce individual rent contributions, allowing you to save or allocate funds elsewhere. Similarly, considering properties that include utilities within the rent or have amenities that save on external memberships can also lighten the financial load.

Ultimately, determining how much rent you can afford when earning $30 an hour isn’t a one-size-fits-all equation. Careful consideration of your income, lifestyle preferences, financial obligations, and local market conditions will guide you to a choice that preserves your financial well-being while enhancing your quality of life. By approaching this decision with a strategic mindset, you can achieve equilibrium between living comfortably and responsibly managing your finances.